Monthly Surplus Or Deficit Calculator

Dec 5, 2024 · To calculate the monthly surplus or deficit, subtract the total monthly expenses from the total monthly income. A positive result indicates a surplus, while a negative result indicates a deficit.

How to Calculate a Cash Surplus in Finance - Bizfluent

Dec 17, 2019 · To calculate a cash surplus, make out a cash flow statement. The statement tracks all the cash you spent and received for the accounting period. If your inflow is greater than your outflow, you have a surplus.

[Solved] how to calculate the surplus or deficit both in ... - Studocu

The surplus or deficit in dollar terms is calculated by subtracting total government spending from total government revenue. Here is the formula: If the result is positive, the government has a surplus. If the result is negative, the government has a deficit.

Difference Between Surplus and Deficit

Oct 4, 2019 · Differences between Surplus and Deficit Definition A surplus is an amount of a resource or asset that exceeds the utilized portion. On the other hand, a deficit is a situation whereby a required resource, especially money, is less than what is required, hence expenses exceed revenues. Types

What is the difference between a surplus and a deficit in …

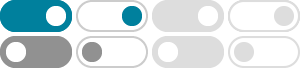

In budgetary accounting, a surplus will exist if estimated revenues exceed the amount of formally approved expenditures. A deficit will exist if estimated revenues are less than the amount of formally approved expenditures. The visual below shows …

Budget Basics: Surplus and Deficits — How Are They Computed?

Oct 5, 2017 · Surplus is the difference between resources and expenditures — with resources being opening fund balance (surplus from prior year) plus revenues then minus expenditures. The chart below is an example for fiscal year 2017 (in millions of dollars)

Budget Calculator - InCharge Debt Solutions

Sep 6, 2024 · Budget Surplus or Budget Deficit? If you have a surplus and use it for savings (preferably 10% of your income) and retirement planning, you’re already ahead of the game. If the expenses overrun your income, that’s when the problems start.

Chapter 18 - Deficits, Surpluses and the Public Debt

Definitions of deficit, surplus and debt. A budget deficit is the amount by which government's expenditures exceed its revenues during a particular year.In contrast, a surplus is the amount by which its revenues exceed expenditures. In 1997 there was a Federal deficit of $22 billion. In 1999 there was a surplus of $125 billion.

2.6.2. Distinction Between Government Budget (Fiscal) Deficit and Surplus

Aug 29, 2024 · Compare and contrast the economic impacts of a government budget deficit and a budget surplus. Evaluate the effectiveness of counter-cyclical fiscal policies during economic downturns, using real-world examples.

Budget surplus: How to calculate and manage the excess or …

Jun 10, 2024 · A budget surplus indicates that the entity has more money than it needs to cover its costs and obligations, and it can use the excess funds for other purposes, such as saving, investing, paying off debt, or spending on new projects. A budget surplus is also known as a positive balance or a net gain. Why is a budget surplus important?